- CALL : (+1) 407-273-1001

- Main Office : (+1) 407-273-1001

Considering an online store with Shopify? Good choice! However, before you go ahead and choose your plan and start your online business, you may want to take a good hard look at the Shopify fees that come with the platform. Shopify fees are not insignificant. They will be an ever-present function of your relationship with Shopify. So, it is important to learn how Shopify fees are calculated before you choose a Shopify plan and start selling products.

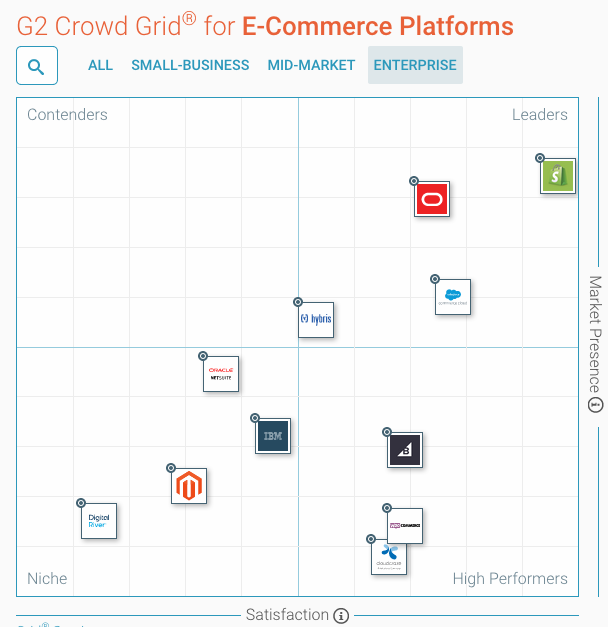

I also want to use this intro to say that even though I will be discussing Shopify’s fees at length in this article, I do not want this article to dissuade you from Shopify altogether. Fees have a negative connotation attached to them for obvious reasons; however, Shopify’s fees take the place of other fees you will have to pay anyway and may not make the platform more expensive than other options; we will get more into this later. It is also important to understand, that even though Shopify may have these fees, they still have one of the best all-around eCommerce platforms on the market today. So if that means paying a premium price for the platform, (Shopify is more expensive than 60% of other platforms according to G2Crowd.com.) it is still very much worth it.

Now that we have that out of the way, we can talk about what this article will provide for you. This article will answer the following questions:

- Why do I have to pay fees?

- What are Shopify Merchant Fees?

- What are Shopify Transaction fees?

- What are Shopify Credit Card fees?

- How are Shopify transaction and credit card fees calculated?

- How do the fees compare to other options?

- What are Shopify Plus Fees?

- Shopify Vs Etsy fees Explained

- Shopify Vs. Amazon fees explained

- Where can I find a Shopify fee calculator?

Shopify Fees Overview – Why Do I have to pay fees?

Before we break down the Shopify fees, I think it is best to explain why Shopify seems like it has more fees than other eCommerce platforms. The reason Shopify has more fees than other platforms is because Shopify provides functionality no other eCommerce platform provides. Shopify has their own payment processing gateway. Shopify does the work of a PayPal or another third-party payment gateway natively inside their platform. Other platforms such as WordPress or BigCommerce will make you choose from a list of third-party merchants; such as Paypal or Stripe. Among other benefits, the native payment functionality inside of Shopify makes setting up and selling with Shopify a breeze.; as there is no additional gateway to integrate with your platform and no need for merchant fee shopping.

Shopify essentially cuts out the middleman and takes all the credit card fees for itself. The revenue they bring in from Credit Card fees from allows them to create an overall better value for you when choosing Shopify over other options. And because they’re in the control of the gateway, they can reduce fees to below other third-party options. We will go more in depth into this, later.

Shopify Merchant Fees

Now that we understand why Shopify has “extra” fees; we can start to break them down. There are two main types of Shopify fees; Credit Card and Transaction fees. These are the Shopify Merchant Fees. You will either be charged one or the other. Transaction fees are fees you incur if you use a Non-Shopify payment gateway, and Credit card fee’s are incurred if you do use the Shopify gateway. Both of these fees scale with the amount of sales you have going through your website. When talking about Shopify fees all together, they make up the “Shopify Merchant Fees.”

Shopify Credit Card Fees

One of the biggest advantages of the Shopify Gateway over third-party gateways is Shopify’s credit card fees decrease depending on the volume. With enough volume, Shopify’s credit card fees dwarf the competition.

It also important to note that Shopify’s initial credit card fee is still very competitive. Common gateway options such as Stripe and Paypal have a flat rate of 2.9% + $.30; the same rate you get with Shopify Basic and Lite.

Shopify Transaction Fees

Shopify Transaction fees are the fees you will only have to pay if you choose to use Shopify as your eCommerce provider and go with a third-party gateway. Shopify wants to give you the flexibility of choosing your third-party merchant. It will just cost you more in Shopify fees. Now, because their revenue model is so dependent on taking over the credit card fees from other payment merchants, they do not like give up the credit card fees. Shopify will let you use a third-party payment provider on their platform, however, if you do, Shopify will charge you a “transaction” fee for not using its gateway. This fee will be added to the credit card fee your payment gateway of choice will charge you. This way Shopify gets a piece of your overall transactions either way and keeps it profit machines turning. These additional transaction fees on top of your third-party gateway fees can add up. For this reason, if you are using Shopify, I strongly suggest you use their gateway as well.

Shopify Fee Calculator

A Shopify fee calculator is valuable for Shopify users because of the way Shopify price scales. Even if you do not want some of the advanced features, if you generate enough revenue, that plan may be the cheapest option for you anyway! One of the best qualities of the Shopify fee and pricing model is that is scales like no other eCommerce platform. With the Shopify platform, it is completely possible to go from small farmers market to enterprise and still have all your needs met along the way. And the best part is, as you grow with Shopify, your eCommerce fees start to shrink. No other eCommerce platform can scale their credit card fees like Shopify because no other eCommerce platform has built their own payment gateway.

For users to find out how much they would have to pay in Shopify fees and/or transaction fees and to find out which plan is right for you, we built a Shopify Fee calculator that provides accurate estimates on how much a user would be paying in credit card fees or transaction fees.

Users can use this Shopify fee calculator by putting in their monthly sales and average sale value numbers. Look for the plan with the lowest fees and that is probably the plan for you!

Shopify Fees Vs the Competition

Comparing Shopify on fees alone may not do a lot of good without the context of knowing that Shopify credit card fees are something you will have to pay anyway, and Shopify is most likely your cheapest credit card rate, especially if you’re an enterprise business.

Shopify Plus Fees

Shopify Plus fees are the only time Shopify will actively negotiate with you on their price. What they are looking for is to charge around .25% of your total sales in credit card fees; once your total sales reach a certain threshold. That threshold is around $800,000 per month or $9.6 million per year. Once your sales are over 800k per month, you are now a prime candidate to be a Shopify Plus customer. It is also important to note that Shopify Plus customers can still use an external payment gateway, however, Shopify will charge a transaction rate of 0.15%.

Shopify Plus is the least expensive option for enterprise businesses by far, and it is not even close. Other enterprise options charge a list price, usually based on revenue or a flat fee, as well as do not cover credit card fees. Shopify on the other hand combines its SaaS price with the credit card fees and scales that total price down to just 0.25% of sales. Shopify plus can easily come in at tens of thousands of dollars cheaper per year when considering list price of the competition and having to pay a full 2.9%+ .30 per transaction. Shopify plus is even so cheap that companies that have slim margins can still save with them.

This savings combined with Shopify’s reliable platform and customization enterprise suite make it a great option for enterprise businesses. According to G2Crowd.com Shopify is taking the enterprise by market by storm with little reason to look over its shoulder.

Shopify Vs Etsy Fees

When it comes to fees, Etsy and Shopify are on different pages.

Etsy has listing fees that you must pay to put your product on the website. Each listing costs you $0.20. You have to pay this regardless if the product sells. This is the major difference between Shopify and Etsy as far as fees go. With Shopify, you can put as many products up as you want, no fees. Once you sell the product you will have to pay another fee of 5% of the sales price.

So even with the base plan you have:

Shopify: (2.9% + $.30) VS. Etsy: (5% + $.20)

Also, note that the $0.20 will be charged even if your product doesn’t sell.

Etsy also has a membership program that provides you with a number of benefits plus a certain number of listings each month. These plans start out at $10 and $20.

Shopify Vs. Amazon Fees

Amazon is another route to go if you want to sell products online. Their fee system is much different than Shopify, Etsy, and most other platforms.

Amazon charges “referral” fees for the products you sell in their store. These fees are different based on the type of product you are selling. Most of these fees have ranges from 8%-45% with an alternative minimum fee, usually $1, where the seller will have to pay whatever is greater.

Some products carry an additional “Closing Fee” of $1.80 when sold. These are products Amazon calls “Media” products and the following categories carry this fee: Books, DVD, Music, Software & Computer/Video Games, Video, Video Game Consoles, and Video Game Accessories.

Amazon has two plans for you to choose from; Professional and Individual. The Individual plan is free but if that’s the plan you choose then you will have to pay an additional “per-item” fee of $0.99 per item that is sold. The Professional plan does not come with that fee and if you plan on selling more than 40 items per month, it is the obvious choice for you.

Comparing this system to Shopify is rather hard as these are about as Apple and Orange two fee systems you can get. However, with the cheapest category being taxed at 8%, you may already be saving money with Shopify. These platforms are for two different types of business. You may find it advantageous to use both at some point.

Conclusion

I hope this article provides answers to any confusion about Shopify fees and prices. If this guide leaves you with any information I hope the following points are among them:

- Shopify Pricing and Fees are related; the more sales you bring through Shopify, the higher your fees will be.

- Shopify charges credit card fees because they have their own gateway, regardless of what eCommerce platform you pick, you will always have to pay gateway fees, and not all of them are as inexpensive as Shopify.

- Shopify will charge you with either Credit Card Fees or Transaction fees, but never both. You will have to pay transaction fees if you choose to use Shopify but not their gateway.

- Shopify fee and pricing structure scales as you increase your sales. Based on your sales, you may find a plan with more features is actually cheaper for you. We provided a Shopify fee calculator so you can find the right plan for yourself.

- Shopify Plus has amazingly low fees compared to other enterprise platforms. The Shopify plus fees are a one of a kind offer. You can easily save tens of thousands of dollars a year by switching to Shopify Plus.

- Etsy and Amazon have much different fee structures than Shopify or other eCommerce platforms.

If all the talk of Shopify fees hasn’t scared you away, go ahead and click the link below to sign up for a Shopify trial. No commitments for 14 days. See how fast you can get up and running!

Jeremy McCourt is an content producer in the enterprise software industry that focuses on NetSuite and related cloud-based software solutions.

Related Posts

What is SuiteCommerce? The Ultimate Guide to NetSuite eCommerce

Contact us! Are you looking for a new type of eCommerce platform…a platform that can be customized from top to bottom? How about a platform that is integrated seamlessly with your back-end, allowing you to…

- Dec 04

- 6 mins read

NetSuite eCommerce Reviews: Standard Vs. Advanced

Contact us! NetSuite eCommerce Reviews Narrowing down your list of eCommerce options is becoming an increasingly arduous task. Years ago, you had a handful of choices; today you have dozens! Even if you wanted to…

- Apr 10

- 4 mins read